What’s good for your customers

is great for

your business.

We connect your

customers with payment providers so that you can

make the sale happen.

We connect your customers with payment providers so that you can make the sale happen.

We connect your customers with payment providers so that you can make the

sale happen.

switchpay products

switchpay

products

You do your thing and we’ll do ours

All shopper funding issues go through us and our providers

Why the customer abandons the

purchase…

Even your best customers don’t always have the full amount.

You lose out on a sale when your customers don’t have money readily available for the things they want or need.

switchpay helps merchants make the sale happen by giving customers the best variety of the most relevant ways to pay.

When customers are overwhelmed with payment options they simply don’t buy.

Having more options doesn’t necessarily give you a better chance of making the sale.

switchpay cuts through the noise – turning viable options into a clear choice.

Credit applications can be a black hole.

Not every customer or purchase type qualifies for every form of credit. Allowing shoppers to blindly apply for credit, leads to denied applications and lost sales.

We suggest the options with the highest chance of approval.

Our special combination

We connect merchants to multiple providers and match customer profiles with viable and preferred payment methods.

Translation: more approvals and more successful transactions.

Alternative to traditional

payment methods

Instore and digital marketing collateral provided

Minimal administration

Ongoing training for merchant and sales agents

Increase in the average ticket

value (ATV) of a customer

Mobile application process by

scanning a QR code in-store or

online by clicking a digital link

Quick turn-around-time on approval

A marketplace of alternative payments at a affordable monthly rate

Making it easy to pay

A smooth customer journey across choosing, applying and paying

Why

Shoppers aren’t aware of alternative payment methods – you need to cut through the noise.

Where

We need to show up when it matters the most – when looking at the price.

How

Redirect shoppers. We’ve got all the bases covered – from price tags to application links.

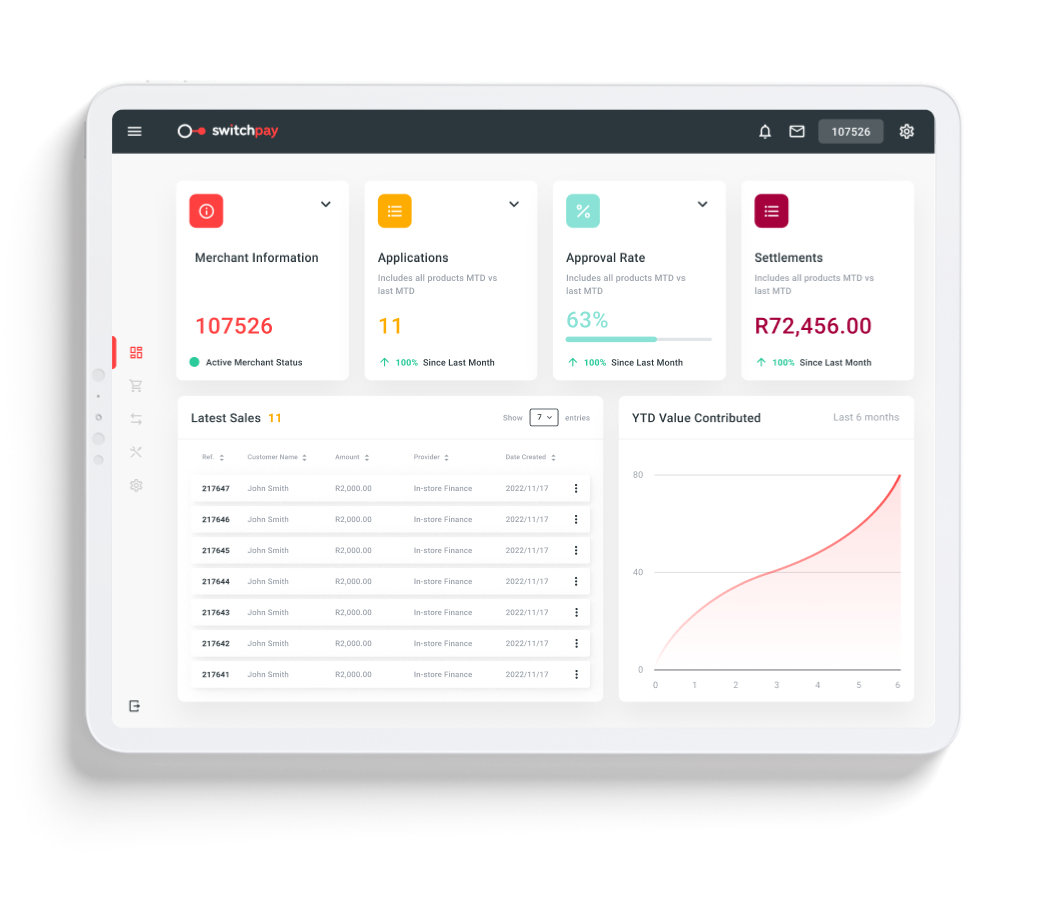

Reporting & Management

All payment information in a centralised view

Features:

Cash-up report

Full payment tracking

(from application to settlement)

Reconciliation

Product performance dashboard

(across all APMs)

Purposeful flexibility

What do you get?

- All the various payment services from one customer access point.

- Store activation & ongoing sales training.

- Implementation of visual proposition marketing collateral.

- Support.

- Central management portal to manage all your cash up and settlement information.

What does it cost?

- Charges vary from 3% – 7.5% depending on the service and provider.

- Net settlement deduction.

- Monthly Support and management Fee of R199 p/m.

Providers – current and coming soon

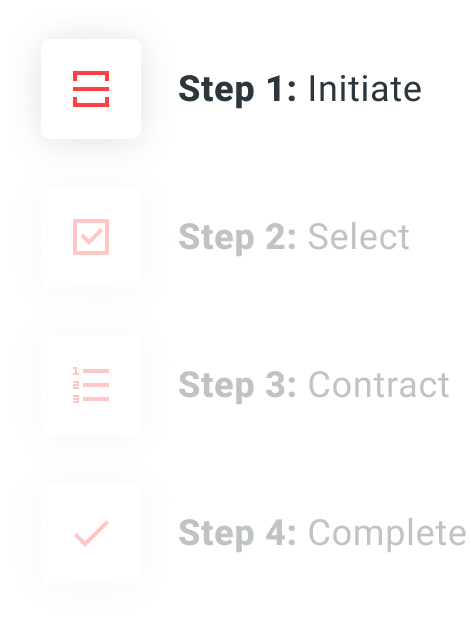

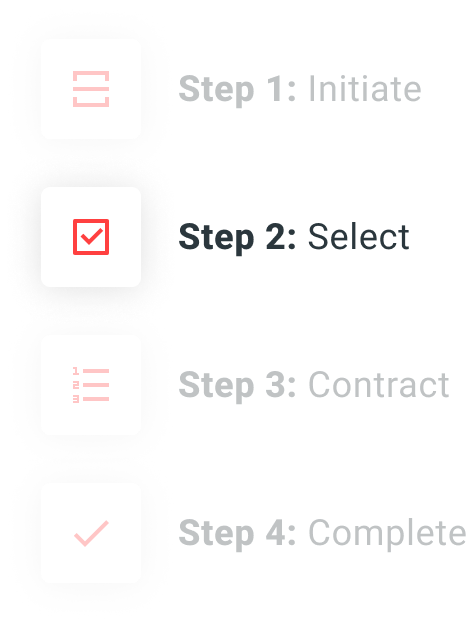

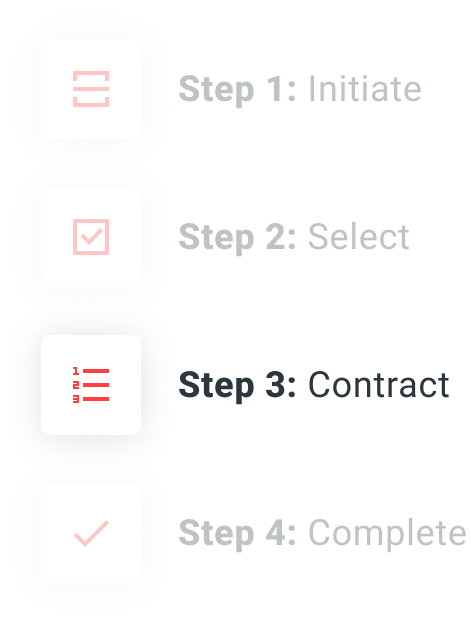

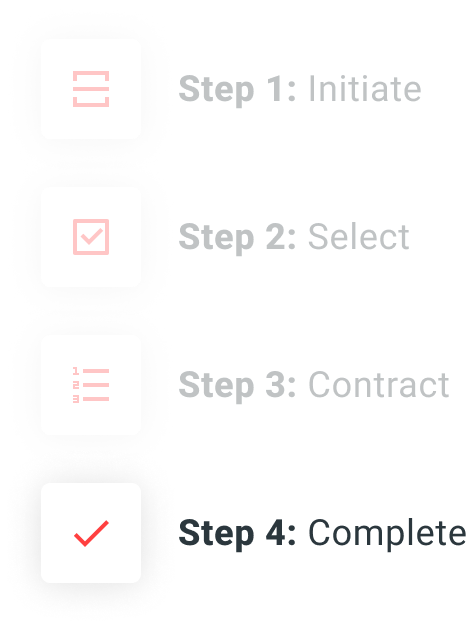

Integration is easy as pie

Onboard with switchpay

Or with our channel partners; Nedbank and Adumo.

We onboard and activate you on the switchpay portal

24 hours is all it takes to onboard and activate your account.

Load the switchpay software onto your devices

You don’t need to do anything. Our channel partners will take care of it.

![[Mockup]-iPhone-15](https://switchpay.co.za/wp-content/uploads/2023/04/Mockup-iPhone-15-6.png)

![[Mockup]-iPhone-15-(1)](https://switchpay.co.za/wp-content/uploads/2023/04/Mockup-iPhone-15-1-1.png)

![[Mockup]-iPhone-15-(2)](https://switchpay.co.za/wp-content/uploads/2023/04/Mockup-iPhone-15-2-1.png)

![[Mockup]-iPhone-15-(3)](https://switchpay.co.za/wp-content/uploads/2023/04/Mockup-iPhone-15-3-1.png)

![[Mockup]-iPhone-13-(1)](https://switchpay.co.za/wp-content/uploads/2023/04/Mockup-iPhone-13-1-1.png)

![[Mockup]-iPhone-15-(4)](https://switchpay.co.za/wp-content/uploads/2023/04/Mockup-iPhone-15-4-1.png)

![[Mockup]-iPhone-13-(2)](https://switchpay.co.za/wp-content/uploads/2023/04/Mockup-iPhone-13-2-1.png)

![[Mockup]-iPhone-13-(3)](https://switchpay.co.za/wp-content/uploads/2023/04/Mockup-iPhone-13-3-1.png)